How to Deliver a Rich Brand Experience in Someone Else’s Marketplace

You don’t have to go to NikeTown to buy a pair of Air Maxes. But if you do, your experience will be exactly how Nike’s brand leadership wants it to be. If all goes well, you’ll cherish those shoes like none you’ve ever owned before, telling all your friends about them and encouraging them to pay a visit to the flagship store.

Of course, there are 1,001 other ways you could buy a new pair of shoes. And those paid to care about the Nike brand need to consider them all. Implementing a brand across third-party retailers is not a new quandary. You’ve always been able to buy trainers in all kinds of retail outlets. “For decades, the physical store has posed businesses with the same question,” says Michael Chadwick, head of strategy and experience at Cheil UK. “How can I present my brand and initiate customer experience optimally, in an environment operated by someone else? In the digital world this just functions with the added wrinkle of often being navigated via mobile devices, where the real estate is magnitudes smaller and oftentimes more prescribed.”

Beyond rethinking and reimagining the approach to brand, there are other options. The first is for brands to make their own commerce destinations as attractive as the third parties’. “This is no easy task,” says Michael, “but the biggest brands are attempting it. Nike have stated their ambition to build a delivery function as fast and efficient as Amazon. Competing with the logistical and functional capabilities is a clear way to reassert power – albeit not a simple or low-cost endeavour.”

Sanne van Ettinger is head of strategy at Build in Amsterdam, an agency that builds ‘digital flagship stores’, so is naturally an advocate for the brand equity that meticulously designed experiences like these can offer. "Every brand that values its unique identity beyond merely being price-driven needs a place where its story can truly flourish,” she says. “This should be a self-controlled environment that authentically reflects the sentimental and emotional aspects of the brand offering a chance for customers to understand, engage, and determine if there’s a genuine connection.”

Amazon isn’t that place, Sanne argues. When customers purchase your products there, they’re immersed in Amazon’s brand experience, not yours. Marketplaces like Amazon, she says, “serve as functional, commercial extensions of your business, focusing on numbers but doing little for long-term sentiment and loyalty. You’ll need to cultivate those elsewhere.”

People are in those marketplaces, though, which means for the majority of brands, selling there is non-negotiable. James Galland, global commerce director at VMLY&R Commerce, acknowledges this. “Step into the boardroom of almost any large blue-chip organisation and you’ll find commerce looms ever present on the priority list,” he says. “Significant pre-covid, the pandemic amplified and refined focus, and then the transformative rise of AI in recent months has driven both potential and interest to new heights. It’s official, commerce is a must win – but beating this drum is yesterday’s news.

“Perhaps more pertinently, in a space that is evolving dynamically, brands need to take ownership of their identity and flex their creative muscle to truly cut through and resonate with the consumer. The digital shelf is infinite with both unprecedented levels of competition and a squeeze on wallets (Feedvisor highlights 66% of shoppers are open to private label online). Cultivating brilliant experience and specifically imbuing brands with creativity to seize attention and stand out from this infinite shelf is everything and needs to be the central bedrock on which strategy is built online.”

Put bluntly, marketplaces outside of your own brand spaces are where people can discover your brand, so beyond commerce, asserting a brand’s presence on them is an act of marketing in itself. Jon Wilkins, global chief strategy officer for Accenture Song Communications points to a radical shift in brand building as a result of how we shop. “As commerce, content and culture come together in daily life, the way that people come to know and experience brands is different,” he says. “Consumers aren’t necessarily getting to know brands through massive print campaigns or blockbuster TV ads. They’re getting to know brands in commerce. Social commerce, for example, has incredible sway: 44% of social media users are more likely to buy brands they’ve never encountered.”

With practically every product or service shoppable from our pockets or desks, researching, rather than casually browsing, has taken a bigger role in the purchasing process of late. Pradeep Kumar, chief data officer at DDB advises brands to consider marketplaces as a way to balance reach and discoverability. “With consumers doing a lot of research brands tend to be more and more discovered in the process,” he says. “Brand discovery begins on marketplaces today. 68% of global B2C e-commerce will come from marketplaces. By listing products on established marketplaces, you can capture a much wider audience and new customers.”

Another practical benefit of these online hubs of commerce is their richness of data. Pradeep feels that marketplaces are an important place to understand how your brand is regarded. “In an increasingly congested online retail environment, marketplaces are going to become more and more significant for brands – as important as social,” he says. “Brands are now analysing reviews and ratings more and more for their creative briefs and content strategy.”

As social commerce grows and grows, marketplaces now offer useful tools to brands to identify partnership opportunities including influencer partnerships. “Building a tangible partnership with a marketplace is providing brands and retailers with access to vital information about shopper habits, as well as emerging behaviours,” says Pradeep. “Both brands and creators recognise the importance of using automation tools to streamline partnerships. 43% of brands use a marketplace to find the best-fit influencers, and 50% of influencers let brands find them through an influencer marketing platform.”

Having a presence on marketplaces goes way beyond practical tools and reach though. Even self-controlled commerce advocate Sanne notes that certain online marketplaces can actually enhance brand sentiment and equity, particularly in the luxury sector. “Take Net-a-Porter, My Theresa, and 1stDibs as examples—these platforms not only drive sales but also lend credibility. However, these high-quality outlets should be considered as complementary channels to the primary space where you dictate your brand narrative.”

Even Amazon has its brand-building potential. As James from VMLY&R Commerce heard at a recent Kantar conference, the commerce giant is viewed as the top ‘stress free Retail experience’ (over-indexing 1.5x versus traditional retail). So much so that shoppers actively look forward to shopping on Amazon (1.2x index) because, he suggests, “it creates simple yet brilliant brand moments.”

No brand that takes pride in its experience should settle for simply making its products available on these marketplaces though. Thankfully there are ever more ways to imprint your brand’s distinctive nature onto the commerce experience in these spaces. “For many companies, the creative magic that goes into campaigns for the traditional channels falls short across their commerce properties, including online marketplaces,” says Jon at Accenture Song. “Just look at the marketplace presence of any brand who’s ad you’ve seen on TV recently – does this storytelling carry through? This is a missed opportunity. But solved by bringing together the insights about customers with brand marketing in creative commerce.”

There’s a creative commerce arms race on right now. “Marketplaces need creativity and experience as much as brands to ensure these brilliant shopper moments stand out,” says James. Every touchpoint in the retailer ecosystem is becoming both addressable and shoppable, and brands need to take advantage of these opportunities. A market leading example of that for James is the ‘I See Coke’ campaign in partnership with Amazon Alexa that has just launched from WPP’s Open X, led by the team at VMLY&R Commerce (UAE & USA).

The campaign uses a new skill that allows Saudi consumers to receive a discount voucher for ordering a Coke to pair with their meal through Alexa as they see the beverage product in a movie or TV show. Simply say “Alexa, I see Coke” when Coke appears on TV or in a movie to receive one of a limited number of discount codes via email to validate online.

Margaux Logan, SVP, head of omnichannel and emerging marketplaces at Publicis Commerce, is excited by the creativity being enabled by marketplaces. “It used to be that leveraging marketplaces was about scale and offering a pure play solution. Now, scale has given way to how deeply brands can dive into audiences through these immersive, full-funnel environments,” she says. Marketplaces now realise that they need to deliver a true destination for consumers to learn more about products and services and part of that comes with offering up unique opportunities for branding that are above and beyond what they are used to seeing – and delivering that in a seamless omnichannel fashion.

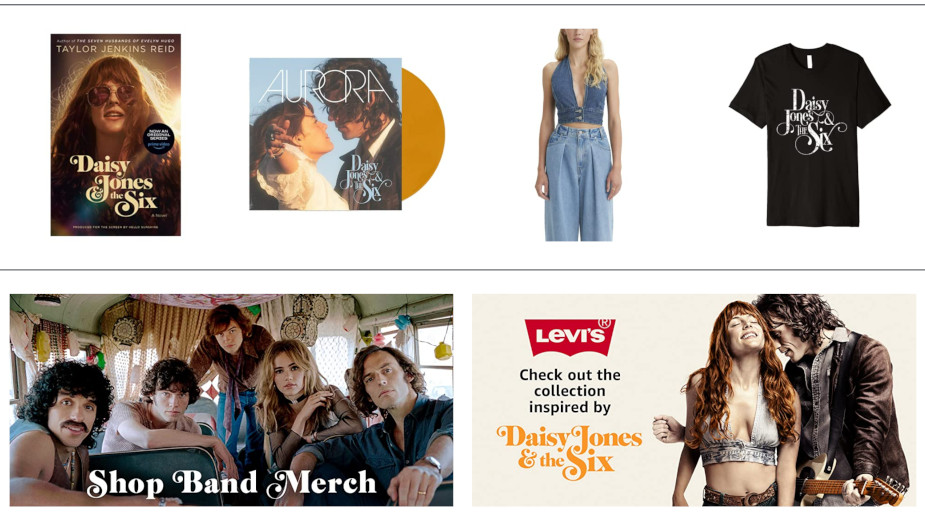

She takes for example what Amazon did for its recent program ‘Daisy Jones and The Six’, building out a comprehensive brand destination where you can stream music from the series, buy the original book, buy the album, identify yourself with one of the characters and shop their look, and more. “Today, it’s more than replicating what brand.com used to be, it’s reimagining the consumer experience,” says Margaux. “If marketplaces want to truly compete in the current environment, they’ll need to become a place where people can discover and purchase, and this will require an effort to step up their creative opportunities – and quickly. Ensuring creative and branding are tailored across the marketplace ecosystem will be key to keeping people engaged, continuously learning and enjoying content throughout their experience.”

DDB’s Pradeep is an advocate for storefronts within marketplaces. Even the smallest-scale trader at the farmers’ market would put up a sign, so why should online marketplaces differ? “This builds visibility, and a superior experience. Stores allow you to showcase your brand and products in a multipage, immersive shopping experience on Amazon,” he says. “A+ content enables brand owners to describe their product features in a different way by including a unique brand story, enhanced images, and text placements.”

Inspire is an example of the rich tools the big marketplaces are building for brands. James describes it as “Amazon’s own response to the TikTok revolution, where the lines with social are being blurred more than ever.” More broadly, the recent launch of Amazon’s Brand Innovation Lab is “empowering ads to create both unique brand moments and cultivate a true full funnel consumer journey,” he says.

There’s been an explosive growth of retail media in the past year. Anyone following the trade press will have noticed it getting more column inches. “Media placements in third-party retailer environments are not just chances to drive conversion – but also to add that brand layer which may be more challenging to implement via store functionalities,” says Michael at Cheil.

James was impressed recently by a case that made the most of Amazon’s retail media offering. The team behind Mario recently partnered with Amazon to launch a full homepage takeover on MAR10 Day in the UK to drive the new movie in tandem with driving Mattel merchandise sales (previously having partnered on bespoke packaging) – all to create unique and memorable brand experiences.

It’s these features that are keeping Amazon so dominant, but it’s a space brands should watch as the e-commerce leviathan’s competitors attempt to lure brand-conscious companies to their spaces. “Social commerce and rapid delivery logistics help differentiate marketplaces,” says Pradeep, “as does the growth of discount marketplaces like Shopee that sell lower-priced items.”

Marketplaces should be seen as partners in brand building, say commerce experts, and brands are now taking the initiative and bringing marketplaces into the strategic planning process. James reminds us that some of the biggest brand owners such as Reckitt and Unilever are vocal on this.

Reckitt’s Annual Report in 2022 read: “Our global relationship with Amazon across CPF labelling, retail management and advertising means we consult on innovation, brand and packaging and share our thinking on market challenges and opportunities. We co-create tests to identify and scale up best practices that expand the reach of our brands. Our use of full-funnel marketing techniques and new ad product is allowing us to reach consumers in innovative and exciting new ways.”

Unilever’s 2021 Annual Report saw the writing on the wall too, stating: “We’re increasingly designing products and organising our business for commerce by working with partners like Amazon”

Reckitt and Unilever fall into Michael’s definition of “the biggest, most powerful brands” – the first of two categories of brand that are best suited to creative commerce in third-party spaces – “businesses able to evoke meaning through the simplest of assets – a colour, a lettermark, a shape, able to bring flavour, even in the most restrictive of environments, thanks to the strength and legacy of the distinctive assets they have built over time.

“Secondly, we have the more interesting cohort – the direct-to-consumer (D2C) native, next-gen brands, designed for and built via the modern marketing environment. These brands are more fluid and able to morph into a variety of environments, yet retaining their core qualities, spreading organically across channels, even where the business has no control: growing through social, marketplaces and communities.”

These brands are defined by underlying values and principles, delivered through behaviours, and built not just by words and images, but also by actions. “So, the potential to feel this brand even in a marketplace with limited ‘branding elements’ is greater,” Michael observes. This provokes a back-to-basics branding principle: how critical product and packaging are. “Growing in the D2C era, the marketplace challenge has been inherent: how to showcase themselves within a limited space? For this reason, the product and packaging alone are enough to express everything necessary – indeed, many tell their brand story as fluently through their product as they do through their marketing.

“They also tend to have a highly developed aesthetic and tone of voice, recognisable wherever they show up – possessing the ability to adapt to any environment, yet always remaining consistent and true to their underlying values. Simply, they are at heart highly authentic, reflected through every aspect of the experience – therefore, space or latitude to dress the product in brand ‘clothing’ is often not necessary.

“In essence, marketplaces may feel restrictive to brands which have learnt to build equity through paid media; but, to the next-gen of D2C native brands – and indeed any brand adopting that mindset – they can be fantastic showcases, as well as providers of reach.”

Selling in someone else’s marketplaces is never going to deliver the perfect creative brand experience that a flagship store or self-controlled platform can. But we’re decades on from the functional, brand-poor e-commerce spaces of the internet’s infancy. “Brands can both engage the consumer through developing mediums and connect through creativity like never before,” says James.

“In essence, brands need to focus on protecting their equity by partnering with marketplaces,” he concludes. “On Amazon specifically this means enrolling in brand registry to minimise content exposure, cultivating a portfolio that can unlock the perception of value without volatility and engaging the retailer as a partner in brand world building. The creative commerce revolution is already here – don’t just buckle in as a passenger for the ride.