M&C Saatchi Announces Unaudited Preliminary Results for 2023

Zillah Byng-Thorne, executive chair, said, “2023 was a year of strategic progress. We have begun to transform into a leaner and more agile business laying the groundwork for sustained growth and improved profitability ahead. There is much more to do on simplifying how we interact with our clients and evolving our go-to-market strategy. With strengthened cash generation, we expect to re-invest in value accretive opportunities to enhance shareholder returns.”

“I am delighted that Zaid Al-Qassab joins as CEO in May to lead M&C Saatchi on its next phase of growth, building on a simplified operating model and supported by our exceptional leaders.”

“We are encouraged by our performance in the start to the year, and while macro-economic uncertainty across our markets remains, our continuing transformation, which is already delivering, underpins our confidence that we will meet expectations.”

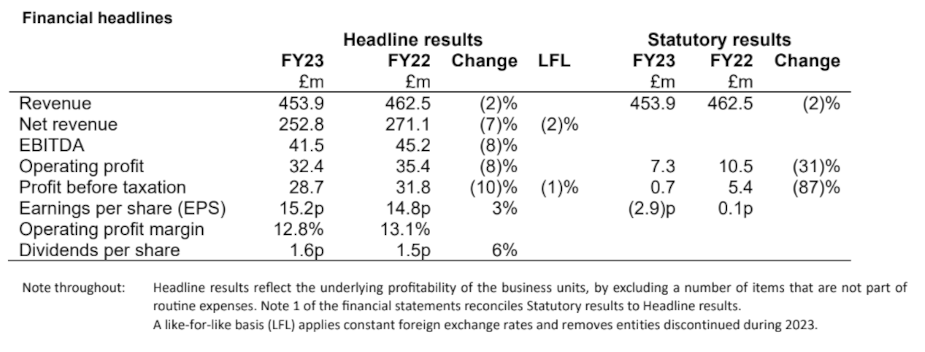

• Net revenue £252.8m (FY22: £271.1m) down 2% excluding the impact of the non-core businesses exited in H2 (LFL)

• Headline operating profit £32.4m (FY22: £35.4m) with H2 growing 30% on the prior H2 as a result of actions including:

o £3.9m of annualised cost savings as we accelerated the global efficiency programme

o Exited non-core businesses representing c.£9m of revenue and c.£3m of operating losses in FY23

• Operating margin 12.8% (FY22: 13.1%) with significant improvement in the H2 margin to 16.9% compared with 8.3% in H1

• Headline profit before tax £28.7m (FY22 £31.8m), down 1% LFL

• Headline EPS 15.2p (FY22 14.8p) up 3% reflecting the reduction in put option liabilities

• Net cash £8.3m (FY22: £30.0m), with liquidity headroom of £55m, largely reflecting the settlement of put option cash liabilities with minority interests now 13% of Headline profits (FY22: 25%)

• Proposed increased final dividend of 1.6p (FY22 1.5p) reflecting our earnings performance

Operational performance

• Challenging market dynamics for Advertising, Consultancy and Media, however, our actions on costs and progress in rationalising the portfolio helped the H2 performance

• Strong performances from Issues and Passions contributed to an increase in their proportion of the portfolio to 34% of net revenue (FY22 27%), demonstrating continuing diversification

• 119 awards and 216 new business wins including World Health Organization, Porsche, adidas, Nike, Revlon, and McDonalds

Transformation programme

• Significant progress made in delivering our efficiency and transformation plans including annualised cost efficiencies of £3.9m achieved in FY23

• New operating model and go-to-market strategy, bringing us closer to clients and better aligning our global capabilities with their needs

• Strengthened and simplified leadership structures led by Zillah Byng-Thorne whose appointment as executive chair was effective from 1 September 2023

• Appointment of Zaid Al-Qassab as CEO, effective 13 May 2024; he brings an extensive track record of advertising and market leadership, managing global teams and brand-building expertise

• New roles of chief people and operations officer to deliver the transformation programme and global chief creative officer to be appointed to deliver the new operating model

Current trading and outlook

• Our confidence in meeting FY24 expectations is underpinned by encouraging Q1 momentum, despite continuing macroeconomic uncertainty

• Improved free cash generation in 2024 with the expected settlement of the majority of the remaining put option liabilities

• We are confident that the structural changes we are making to our cost base alongside our new operating model are increasing our operational leverage potential which will help support future margin expansion

PRELIMINARY ANNOUNCEMENT

This preliminary announcement was approved by the Board on 9 April 2024. It is not the Group’s statutory accounts. Copies of the Group’s audited statutory accounts for the year ended 31 December 2023 will be available on the Company’s website in the coming days, and a printed version will be dispatched to shareholders thereafter.

2023 RESULTS PRESENTATION

An in-person presentation will be held today at 9:00am at 36 Golden Square, London, W1F 9EE, hosted by Zillah Byng-Thorne, executive chair, and Bruce Marson, chief financial officer.

Please email mcsaatchi@headlandconsultancy.com to register to attend.

A webcast is available for those not able to attend in person.

A replay will be also available on the Company’s website following the event.

The results can be found here.