WPP Publishes 2019 Interim Results

WPP has published its 2019 interim results, showing that performance in the second quarter was slightly ahead of internal expectations, in line with its full-year guidance, but profits were down.

Mark Read, chief executive officer of WPP, said: “WPP’s performance in the second quarter was slightly ahead of our internal expectations but in line with our full-year guidance and three-year strategic targets. Clients are responding well to our new offer, as evidenced by recent wins and expanded assignments including from eBay, Instagram and L’Oréal. An encouraging number of our businesses and markets are achieving good growth.

“That said, we are still in the early stages of our three-year turnaround plan, and we remain focused on returning the company to sustainable growth over that period. Our guidance for the full year is unchanged.”

First half and Q2 financial highlights

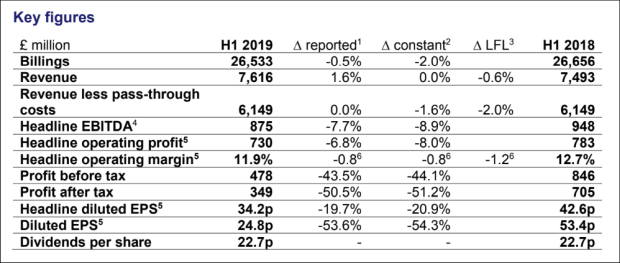

◼ Reported revenue up 1.6%, constant currency revenue flat, LFL revenue down 0.6% (Q2 up 0.1%)

◼ H1 LFL revenue less pass-through costs -2.0%; Q2 -1.4% (Q1 -2.8%)

◼ Q2 LFL revenue less pass-through costs improvements in key markets: USA -5.4%, UK +1.3%

◼ H1 headline operating margin 11.9%, down 1.2 margin points LFL, reflecting revenue less pass-through costs trend; IFRS 16: Leases benefit on reported headline margin 0.5 margin points

◼ Reported profit before tax down 44% driven primarily by a significant H1 2018 exceptional gain that has not been repeated (£117 million impact) and a charge on the revaluation of financial instruments versus a credit in 2018 (£138 million impact)

◼ Average net debt £4.384 billion, down £709 million in constant currency compared with first half of 2018 supported by disposal programme

◼ 2019 guidance reiterated: LFL revenue less pass-through costs down 1.5% to 2.0%; headline operating margin to revenue less pass-through costs down around 1.0 margin point on a constant currency basis (excluding the impact of IFRS 16)

Strategic highlights

◼ New strategy delivering solid new business performance and strong client retention

◼ Agreement in July to sell 60% of Kantar: c.$1.9 billion for de-leverage and c.$1.2 billion to be returned to shareholders

◼ 44 disposals over the last 15 months, further simplifying WPP and positioning it for future growth

◼ Ongoing programme of investment in new leadership and creative firepower, with focus on the US

Mark continued: “We continue to simplify WPP, with a more integrated offer for our clients, better, more collaborative working environments for our people, and less complicated management structures.

“When the Kantar transaction completes, our disposal programme will have generated proceeds of c.£3.6bn, allowing us to return significant amounts to shareholders and reduce our leverage to the low end of the target range.

“The progress we have made and the positive new business momentum are reasons for optimism. As a creative transformation company with stronger, more tech-enabled agencies, we are well placed for the future as clients look for modern partners to help them navigate an increasingly complex and challenging marketing landscape.”