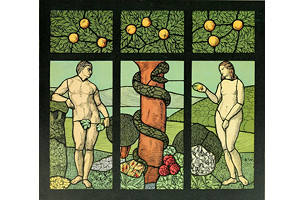

Forbidden Fruit: Ireland’s Ad Industry on the €13 Billion Apple Tax Bill

Confidence in the Irish advertising industry has been positively soaring. According to this year’s member survey from the Institute of Advertising Practitioners in Ireland (IAPI), no agencies predict a decrease in their turnover in 2016 and 77% expect an increase (74% expect an increase in the industry generally). Compare that to 2013 when nearly half of respondent agencies predicted a fall. Employment in the industry has grown 32.2% in four years (the highest level since the survey began in 2013) and 77% say they expect staffing levels to grow further. New opportunities for growth have been identified and optimism is high.

Agencies are also seeking opportunities beyond the Emerald Isle; 46% of respondents say they’re pursuing new global accounts and a further 26% are pursuing increased business from existing global clients.

But if the future looks as rosy as a Pink Lady, last week’s news that the EU has ordered the Irish Government to recoup €13 billion (plus interest) in tax from Apple has sparked debate in the street and in the newspapers – and uncertainty in the boardroom.

Patrick Meade, MD at Boys and Girls, says that there’s a big concern that the situation could tarnish the gleam of digital Dublin – and that could have consequences down the line for advertising and marketing businesses. “In general this can’t be good news for the industry. It’s embarrassing for us as a nation and large multinationals don’t like being embarrassed,” he says. “Having companies like Apple based here is great for the image and reputation of Ireland on the international stage and if this ruling threatens that, the effect will trickle down to our industry at some point.”

He also notes that the combination of the ruling and the UK’s Brexit vote might lead to a more restrained than predicted year ahead. Ireland is a close trading partner with the UK; two-way trade between the two is estimated to be worth around €1 billion a week. “Further economic uncertainty following so closely on the back of Brexit isn’t ideal as businesses look to fix their budgets for next year. It could induce a sense of caution which could lead to more conservative marketing spend in 2017,” he says.

Deirdre Gunning, Group Account Director at Chemistry – speaking personally – agrees that the timing of the news is particularly bad given Ireland’s Brexit worries and says that the Irish government should be more assertive in fighting the EU’s ruling. “Our government should be standing up to these guys and fighting for our rights to autonomy in negotiations with multi-nationals. Being docile is not good for us. Being docile will position us as a doormat and that will not be good for our position when Brexit negotiations happen,” she says.

The current EU ruling targets Apple specifically – while Ireland’s corporate tax rate is publically stated as 12.5%, the EU’s competition commissioner says that between 1991 and 2007, Irish loopholes allowed Apple to shrink its tax bill significantly.

“What’s at issue here is the cloaked and murky funnelling through the country of billions of dollars’ worth of sales that avails of a further and more significant tax rate of only 0.5%,” explains Graham Nolan, Head of Strategy at digital transformation agency CKSK, which has offices in Dublin and New York.

Public opinion is split as to what the government should do – take the money and invest in the country after years of cuts and austerity or side with the tech giants to retain the comfortable tax regime?

“As soon as the Apple tax affair broke last week on social media, the man in the street was quick to equate this to just over €3,000 per head of population in Ireland,” notes Graham. “Before it even began to trend, we had it already spent.”

Patrick Meade sees both sides of the argument and says it’s hard to judge what the long-term consequences of either decision could be for the creative and digital industry specifically. The huge lump sum could lift quality of life and consumer confidence… or it could scare off big employers (Apple employs 5,500 people in Ireland and US companies employ around 140,000 Irish people in the country). Ultimately, he thinks that the government has to appeal the decision and support the businesses it has spent so long trying to attract.

“If we take the payment from Apple then it would be a boost to our economy and our current levels of debt which is great for Ireland. However that would all depend on how the money was used by the government,” he says. “The flip side is that taking the money could be damaging to the relationship with Apple and to our reputation internationally with big business. That could impact us longer term which could trickle down to every industry, including our own.”

However, while only Apple is being targeted for now, the question remains whether other Ireland-based multinationals will also be targeted. “What would be of greater concern is that this isn’t an isolated incident and more organisations that are more directly linked to agencies such as Google and Facebook could be caught up in the fall out which would be more damaging in the short term,” adds Patrick.

That’s something Graham also notes, particularly as he suspects that the issue will not disappear even if Apple wins. “What’s at stake from an economic perspective is the longevity of European operations like Apple, Google, Facebook and the rest. Should we allow Europe to tackle our very generous tax breaks, the fear is we lose them. However regardless of whether it is this fight or the next, the problem does not go away because the days of lax tax frameworks will soon be coming to an end regardless... Then we’ll really see if the global digital giants love us for our brains or our generosity of spirit when it comes to the tax money that we are happy to turn a blind eye to.”

And it’s true that, in the digital and creative sectors, the last few years of growth have allowed businesses to invest in the local talent. What’s frustrating for Deirdre Gunning is that the issue also threatens to overshadow everything else that Ireland has to offer international business. “We in Ireland also offer a hell of a lot more than just good tax packages to the tech giants. We have a gifted and skilled work force who are highly educated and highly motivated, adding a lot of value to these companies. The fact that we are an English speaking country is helpful for the USA companies but not the only selling point,” she says. “As well as highly skilled people, we have excellent natural resources and an ideal climate for many of these companies’ requirements.”

In the immediate term, the Irish advertising’s growing presence on the international stage means that there’s a lot to be positive about and any fallout from Apple-gate remains unclear. On Friday the Irish government said that it would appeal the decision, and whatever happens the industry will be watching closely.

Image Attribution: By Bernhard Wenig (Deutsche Kunst und Dekoration) [Public domain], via Wikimedia Commons