UK Ad Industry Remains Resilient Despite Brexit Fears

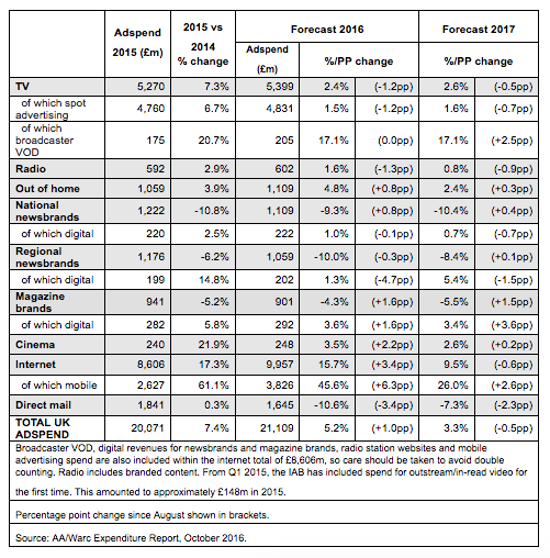

The UK’s authoritative advertising statistics, released today by the Advertising Association/Warc, show that UK advertising expenditure posted 5.2% growth in H1 2016 despite economic uncertainty before the EU referendum.The growth rate was 0.4 percentage points ahead of forecast, with adspend reaching a record £9,999m in total for the first six months of the year.

Growth in internet adspend was particularly strong, increasing 16.9% to reach £4,777m in H1. Within this category, mobile spend grew 52.6% to £1,723m – and for the first time mobile now accounts for over half of all online display adspend in the UK.

Digital formats continue to thrive across all media, with online video adspend increasing by 66.4%, to £252m, while native advertising spend also grew 29.9% to £451m in H1. Digital out of home increased 28.9% in H1 to reach £176m, taking out of home’s total spend to £511m.

In light of the data, full year growth forecasts for 2016 have been revised up 1.0pp to 5.2%. However the forecast for 2017 has been downgraded by half a point to 3.3%, as the impacts of the EU referendum result begin to unfold.

Tim Lefroy, Chief Executive at the Advertising Association said:

“Investment in UK advertising remains strong this year, and the trend towards digital and mobile continues – but the medium term is more complex. The Government should avoid any regulatory uncertainty that might affect advertising's stimulus to the economy.”

The Advertising Association/Warc Expenditure Report is the definitive measure of advertising activity in the UK. It is the only source that uses advertising expenditure gathered from across the entire media landscape, rather than relying solely on estimated or modelled data. With total market and individual media data available quarterly from 1982, it is the most reliable picture of the industry and is widely used by advertisers, agencies, media owners and analysts.

At-a-glance media summary

· TV spot expenditure grew 0.8% year-on-year in Q2, and 2.1% in H1 to a total of £2,387m. As a consequence of weaker than anticipated Q2 performance, full year expectations for TV spot have been downgraded to 1.5% growth. However, video on demand (VOD) adspend is expected to grow by 17.1%.

· Radio advertising expenditure fell 2.2% YOY in Q2, but still increased 0.5% in H1 overall, to a total of £242m. Factoring in branded content, radio adspend is forecast to increase 1.6% in 2016 and 0.8% in 2017.

· Out of home (OOH) adspend increased almost four points ahead of forecast to £273m in Q2; +9.6% YOY. This was driven by 30.5% growth in the digital out of home market. Digital out of home accounted for over a third of total OOH adspend during the first half of the year, at £176m. Growth for total OOH is predicted to continue at 4.8% in 2016 and 2.4% in 2017.

· National newsbrands advertising revenue dipped 7.3% YOY to a total of £270m in Q2. Q2 print adspend fell 9.2% to £218m, though digital ad revenues returned to growth; up 1.4% to £52m. Total national newsbrand adspend is forecast to decrease 9.3% in 2016, and 10.4% in 2017.

· Regional newsbrands adspend fell 12.7% YOY to £263m in Q2, the result of a 13.2% dip for print (to £214m) and a 10.4% fall for digital (to £49m) - compared to a very strong Q2 2015. Total ad revenue for regional titles is expected to contract by 10% in 2016 and 8.4% in 2017.

· Magazine brands adspend decreased by 5.1% to £225m during Q2. In H1, ad revenue across all titles dipped 4.6% to £432m. This represents a 7.7% drop for print (to £300m) and a 3.3% rise for digital adspend (to £133m). Advertising revenue for all magazine brands is forecast to decrease 4.3% in 2016 and 5.5% in 2017.

· Cinema adspend rose 13.7% YOY to £45m in Q2. This was 1.8pp ahead of forecast and puts cinema on course to reach a total of £248m for 2016 – up 3.5% on 2015’s record high. Further growth of 2.6% is anticipated in 2017.

· Internet (including mobile) rose 16.6% to £2,398m during Q2 2016, representing 48% of all UK adspend during the quarter. Total internet adspend is forecast to grow 15.7% in 2016, and 9.5% in 2017. Mobile adspend grew 49.5% in Q2 to reach £892m.

· Direct mail Direct mail adspend fell 13.3% in Q2. The vast majority of this decline was recorded among SMEs – i.e. non